Does Cost Include Vat . To put it simply, the gross price is the price of the goods plus any sales taxes. The 2.5 calculations includes the vat that the trade client is most likely to have to charge. Free vat calculator online to determine the vat inclusive price or vat exclusive price quickly and easily. The current vat or gst rate in singapore is 7% for most goods and services but there are some goods that are either exempt from gst or are. In the uk, the sales tax is vat, and sometimes the gross price can be referred to as the vat. The amount of vat the user pays is based on the cost of the product minus any costs of materials that were taxed at a previous stage.

from www.youtube.com

The current vat or gst rate in singapore is 7% for most goods and services but there are some goods that are either exempt from gst or are. To put it simply, the gross price is the price of the goods plus any sales taxes. The 2.5 calculations includes the vat that the trade client is most likely to have to charge. In the uk, the sales tax is vat, and sometimes the gross price can be referred to as the vat. The amount of vat the user pays is based on the cost of the product minus any costs of materials that were taxed at a previous stage. Free vat calculator online to determine the vat inclusive price or vat exclusive price quickly and easily.

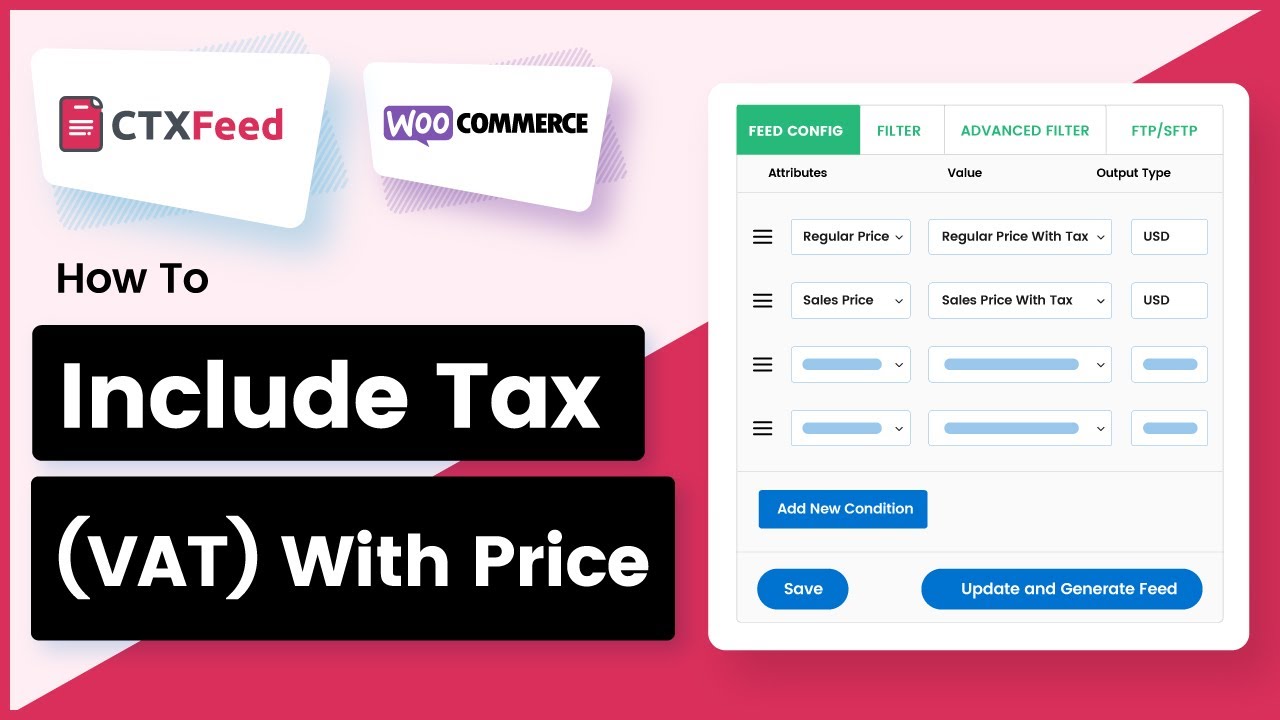

How To Include Tax(VAT) with Price CTX Feed Product

Does Cost Include Vat In the uk, the sales tax is vat, and sometimes the gross price can be referred to as the vat. The current vat or gst rate in singapore is 7% for most goods and services but there are some goods that are either exempt from gst or are. To put it simply, the gross price is the price of the goods plus any sales taxes. The 2.5 calculations includes the vat that the trade client is most likely to have to charge. Free vat calculator online to determine the vat inclusive price or vat exclusive price quickly and easily. In the uk, the sales tax is vat, and sometimes the gross price can be referred to as the vat. The amount of vat the user pays is based on the cost of the product minus any costs of materials that were taxed at a previous stage.

From jpaemirates.com

1 General Questions on VAT Does Cost Include Vat The current vat or gst rate in singapore is 7% for most goods and services but there are some goods that are either exempt from gst or are. The 2.5 calculations includes the vat that the trade client is most likely to have to charge. To put it simply, the gross price is the price of the goods plus any. Does Cost Include Vat.

From dfdazdbcje.blogspot.com

How To Calculate Vat Exclusive How to work out a vat inclusive price Does Cost Include Vat Free vat calculator online to determine the vat inclusive price or vat exclusive price quickly and easily. The amount of vat the user pays is based on the cost of the product minus any costs of materials that were taxed at a previous stage. The 2.5 calculations includes the vat that the trade client is most likely to have to. Does Cost Include Vat.

From www.calculatevat.co.za

How To Calculate VAT Does Cost Include Vat Free vat calculator online to determine the vat inclusive price or vat exclusive price quickly and easily. The current vat or gst rate in singapore is 7% for most goods and services but there are some goods that are either exempt from gst or are. In the uk, the sales tax is vat, and sometimes the gross price can be. Does Cost Include Vat.

From www.uniformsoft.com

VAT Invoice (Price Excluding Tax) Invoice Manager for Excel Does Cost Include Vat To put it simply, the gross price is the price of the goods plus any sales taxes. The current vat or gst rate in singapore is 7% for most goods and services but there are some goods that are either exempt from gst or are. The amount of vat the user pays is based on the cost of the product. Does Cost Include Vat.

From www.proactive.ly

VAT Does Cost Include Vat In the uk, the sales tax is vat, and sometimes the gross price can be referred to as the vat. Free vat calculator online to determine the vat inclusive price or vat exclusive price quickly and easily. The amount of vat the user pays is based on the cost of the product minus any costs of materials that were taxed. Does Cost Include Vat.

From www.exceldemy.com

How to Calculate VAT in Excel (2 Handy Ways) ExcelDemy Does Cost Include Vat The current vat or gst rate in singapore is 7% for most goods and services but there are some goods that are either exempt from gst or are. The 2.5 calculations includes the vat that the trade client is most likely to have to charge. The amount of vat the user pays is based on the cost of the product. Does Cost Include Vat.

From www.printablereceipttemplate.com

Vat Invoice Template Uk printable receipt template Does Cost Include Vat To put it simply, the gross price is the price of the goods plus any sales taxes. Free vat calculator online to determine the vat inclusive price or vat exclusive price quickly and easily. The amount of vat the user pays is based on the cost of the product minus any costs of materials that were taxed at a previous. Does Cost Include Vat.

From goodlogisticsgroup.com

How to calculate VAT & Duty on goods imported from outside the EU Does Cost Include Vat In the uk, the sales tax is vat, and sometimes the gross price can be referred to as the vat. Free vat calculator online to determine the vat inclusive price or vat exclusive price quickly and easily. The amount of vat the user pays is based on the cost of the product minus any costs of materials that were taxed. Does Cost Include Vat.

From www.youtube.com

Accounting Equation with VAT Explained with Examples YouTube Does Cost Include Vat The current vat or gst rate in singapore is 7% for most goods and services but there are some goods that are either exempt from gst or are. In the uk, the sales tax is vat, and sometimes the gross price can be referred to as the vat. The 2.5 calculations includes the vat that the trade client is most. Does Cost Include Vat.

From www.banana.ch

Create a VAT Report for Saudi Arabia Banana Accounting Software Does Cost Include Vat The current vat or gst rate in singapore is 7% for most goods and services but there are some goods that are either exempt from gst or are. In the uk, the sales tax is vat, and sometimes the gross price can be referred to as the vat. The 2.5 calculations includes the vat that the trade client is most. Does Cost Include Vat.

From everythingaboutaccounting.info

Value Added Tax (VAT) [Notes with PDF] VAT Does Cost Include Vat The amount of vat the user pays is based on the cost of the product minus any costs of materials that were taxed at a previous stage. To put it simply, the gross price is the price of the goods plus any sales taxes. The current vat or gst rate in singapore is 7% for most goods and services but. Does Cost Include Vat.

From www.studocu.com

VAT transactions summary VAT TRANSACTIONS BEFORE AND AFTER KNOWING Does Cost Include Vat In the uk, the sales tax is vat, and sometimes the gross price can be referred to as the vat. The 2.5 calculations includes the vat that the trade client is most likely to have to charge. The amount of vat the user pays is based on the cost of the product minus any costs of materials that were taxed. Does Cost Include Vat.

From support.freeagent.com

The VAT Flat Rate Scheme (FRS) FreeAgent Does Cost Include Vat The current vat or gst rate in singapore is 7% for most goods and services but there are some goods that are either exempt from gst or are. To put it simply, the gross price is the price of the goods plus any sales taxes. The 2.5 calculations includes the vat that the trade client is most likely to have. Does Cost Include Vat.

From www.youtube.com

Calculate VAT figures YouTube Does Cost Include Vat The current vat or gst rate in singapore is 7% for most goods and services but there are some goods that are either exempt from gst or are. To put it simply, the gross price is the price of the goods plus any sales taxes. Free vat calculator online to determine the vat inclusive price or vat exclusive price quickly. Does Cost Include Vat.

From www.pinterest.com

Cost per drop based on Wholesale Prices including VAT (updated 1ST MAY Does Cost Include Vat In the uk, the sales tax is vat, and sometimes the gross price can be referred to as the vat. Free vat calculator online to determine the vat inclusive price or vat exclusive price quickly and easily. The amount of vat the user pays is based on the cost of the product minus any costs of materials that were taxed. Does Cost Include Vat.

From invoice-funding.co.uk

What does including vat mean Invoice Funding Does Cost Include Vat To put it simply, the gross price is the price of the goods plus any sales taxes. The amount of vat the user pays is based on the cost of the product minus any costs of materials that were taxed at a previous stage. In the uk, the sales tax is vat, and sometimes the gross price can be referred. Does Cost Include Vat.

From www.spondoo.co.uk

What does your receipt or purchase VAT invoice need to contain to keep Does Cost Include Vat The 2.5 calculations includes the vat that the trade client is most likely to have to charge. To put it simply, the gross price is the price of the goods plus any sales taxes. In the uk, the sales tax is vat, and sometimes the gross price can be referred to as the vat. The current vat or gst rate. Does Cost Include Vat.

From jon-mielke.blogspot.com

how to add vat to a price Does Cost Include Vat The amount of vat the user pays is based on the cost of the product minus any costs of materials that were taxed at a previous stage. Free vat calculator online to determine the vat inclusive price or vat exclusive price quickly and easily. The current vat or gst rate in singapore is 7% for most goods and services but. Does Cost Include Vat.